All Categories

Featured

Table of Contents

It's still fully moneyed in the eyes of the common life insurance business. It's vital that your policy is a combined, over-funded, and high-cash value policy.

Riders are added attributes and advantages that can be added to your policy for your certain demands. They allow the insurance holder purchase much more insurance or alter the conditions of future purchases. One factor you may want to do this is to plan for unforeseen illness as you grow older.

If you toss in an extra $10,000 or $20,000 upfront, you'll have that money to the bank from the start. These are just some steps to take and take into consideration when establishing your way of life financial system. There are numerous different methods which you can take advantage of way of life banking, and we can assist you locate te best for you.

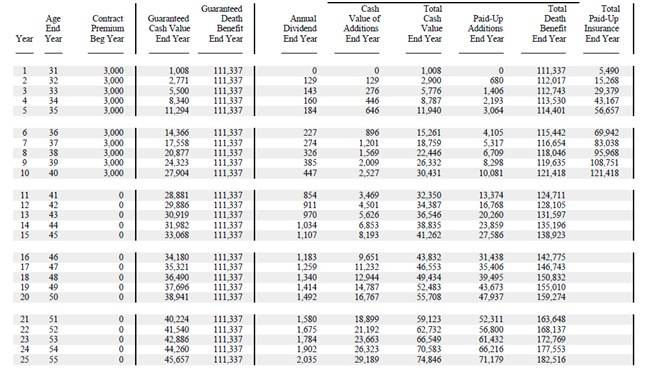

Infinite Banking Example

When it comes to financial planning, entire life insurance coverage frequently stands out as a prominent option. While the idea may sound appealing, it's vital to dig much deeper to comprehend what this truly means and why watching whole life insurance in this method can be misleading.

The idea of "being your very own bank" is appealing because it suggests a high level of control over your financial resources. This control can be imaginary. Insurance provider have the supreme say in just how your policy is managed, including the terms of the fundings and the rates of return on your cash worth.

If you're considering whole life insurance policy, it's important to watch it in a wider context. Entire life insurance can be a valuable device for estate planning, supplying an ensured death advantage to your recipients and potentially offering tax obligation benefits. It can likewise be a forced cost savings lorry for those who have a hard time to save cash constantly.

It's a type of insurance coverage with a savings component. While it can supply steady, low-risk development of cash money worth, the returns are usually less than what you could achieve with various other investment vehicles. Before jumping right into whole life insurance with the concept of boundless financial in mind, make the effort to consider your financial objectives, threat tolerance, and the complete range of economic products available to you.

Infinite banking is not an economic remedy. While it can function in particular scenarios, it's not without threats, and it needs a considerable commitment and understanding to take care of successfully. By recognizing the potential challenges and understanding truth nature of entire life insurance policy, you'll be better geared up to make an educated decision that sustains your monetary health.

Rather than paying financial institutions for things we require, like vehicles, houses, and school, we can buy methods to keep more of our money for ourselves. Infinite Financial approach takes an innovative method toward personal money. The strategy basically includes becoming your very own bank by utilizing a dividend-paying entire life insurance policy plan as your bank.

Infinite Banking Concept Example

It provides considerable growth gradually, changing the conventional life insurance coverage policy into a durable monetary device. While life insurance coverage companies and banks risk with the fluctuation of the marketplace, the negates these threats. Leveraging a cash value life insurance coverage policy, people take pleasure in the benefits of ensured growth and a death advantage safeguarded from market volatility.

The Infinite Financial Idea shows just how much wealth is completely transferred away from your Household or Service. Nelson likewise takes place to describe that "you finance everything you buyyou either pay rate of interest to another person or offer up the rate of interest you could have or else earned". The real power of The Infinite Banking Idea is that it solves for this trouble and equips the Canadians that embrace this idea to take the control back over their funding requires, and to have that cash receding to them versus away.

This is called shed chance cost. When you pay cash money for points, you completely surrender the opportunity to gain rate of interest on your own cost savings over numerous generations. To fix this issue, Nelson created his own financial system via the use of returns paying taking part entire life insurance coverage policies, ideally through a mutual life company.

As an outcome, policyholders must meticulously evaluate their monetary objectives and timelines prior to opting for this approach. Authorize up for our Infinite Banking Course.

Infinite Banking Services Usa

Keep in mind, The limitless Financial Principle is a procedure and it can drastically boost everything that you are currently carrying out in your present monetary life. How to obtain nonstop COMPOUNDING on the normal payments you make to your cost savings, reserve, and retirement accounts How to place your hard-earned cash so that you will never have an additional sleep deprived evening worried concerning exactly how the markets are mosting likely to react to the next unfiltered Presidential TWEET or worldwide pandemic that your family just can not recuperate from How to pay yourself initially making use of the core concepts taught by Nelson Nash and win at the money game in your very own life How you can from 3rd event financial institutions and loan providers and relocate into your own system under your control A structured way to see to it you hand down your wealth the means you want on a tax-free basis How you can relocate your money from forever exhausted accounts and change them into Never strained accounts: Listen to specifically how individuals just like you can execute this system in their own lives and the influence of putting it right into action! That developing your own "Infinite Banking System" or "Wealth System" is potentially one of the most outstanding method to shop and safeguard your money circulation in the country Just how executing The Infinite Financial Refine can produce a generation causal sequence and show true stewardship of money for numerous generations Just how to be in the vehicle driver's seat of your financial fate and finally develop that is protected and just goes one directionUP! The period for establishing and making significant gains via boundless financial mainly depends upon different elements distinctive to a person's financial setting and the policies of the banks providing the service.

A yearly returns payment is another massive advantage of Boundless financial, additional highlighting its appearance to those geared towards long-term economic growth. This technique needs cautious consideration of life insurance policy prices and the interpretation of life insurance policy quotes. It's important to examine your credit record and challenge any existing bank card debt to ensure that you are in a favorable placement to take on the strategy.

A vital element of this strategy is that there is ignorance to market changes, due to the nature of the non-direct acknowledgment fundings made use of. Unlike investments connected to the volatility of the marketplaces, the returns in unlimited banking are secure and foreseeable. Extra cash over and over the costs payments can additionally be added to speed up development.

How To Be Your Own Bank

Policyholders make routine premium payments into their getting involved entire life insurance plan to keep it in force and to build the plan's complete money worth. These superior settlements are commonly structured to be constant and predictable, making certain that the policy stays energetic and the cash money value remains to grow gradually.

The life insurance coverage policy is developed to cover the entire life of an individual, and not simply to assist their beneficiaries when the individual dies. That stated, the plan is taking part, suggesting the plan proprietor becomes a component owner of the life insurance company, and takes part in the divisible earnings produced in the type of dividends.

"Below comes Profits Canada". That is not the case. When rewards are chunked back right into the plan to acquire compensated enhancements for no additional expense, there is no taxable event. And each compensated addition likewise obtains returns every year they're proclaimed. Currently you might have heard that "rewards are not ensured".

Latest Posts

Bank On Yourself Review Feedback

Whole Life Insurance Infinite Banking

Concept Bank